Inside the mortgage credit, the word 2nd domestic typically relates to a secondary house, eg a beach vacation. An excellent Va loan can not be always get these house.

Having said that, an excellent next primary residence is actually a property for which you spend more than 6 months inside the per year. To-be eligible, you really need to have sufficient entitlement and you will income so you’re able to qualify for one another properties.

A beneficial Va financing was a mortgage guaranteed by the Agencies off Pros Items (VA) only for effective-obligation armed forces service participants, pros and qualified thriving spouses purchasing or refinance a home with no downpayment or home loan insurance coverage.

The fresh new Virtual assistant bonus entitlement makes it possible to funds a property which have a cost of more than $144,000 perhaps rather than a deposit or even get the second no. 1 house. The fresh Va loan entitlement is the maximum buck amount you to this new Va will pay towards the home loan company for people who wade into the financial default, otherwise don’t pay-off the loan.

That have Va fund, there have been two different entitlement: first entitlement and you will extra entitlement. Might entitlement try $thirty-six,000, or twenty-five% regarding $144,000. For residential property which have a sticker price more than $144,000, new Va provides a bonus entitlement well worth twenty-five% of the home amount borrowed. Lenders allow you to borrow doing four times the fresh entitlement without advance payment.

Full compared to. left entitlement: To own army consumers with complete entitlement, there isn’t any mortgage maximum. not, consumers that have kept entitlement has a loan restrict based on their state. Full entitlement typically means you possibly never used the Va financing work for, or paid down a past Va mortgage in full and offered the brand new assets (which regulates your complete entitlement). On the other hand, leftover entitlement means you may be still using the Virtual assistant loan straight back or reduced your Va mortgage in full whilst still being individual the latest family. By using a good Virtual assistant loan to buy one minute family, your kept entitlement will come in.

Let’s have a look at a scenario on the remaining entitlement. We shall assume you currently very own a property which you purchased for $2 hundred,000 having a beneficial Virtual assistant financing and no downpayment. Therefore, you had to utilize $50,000 value of entitlement to buy it, otherwise twenty five% of your price.

If you aren’t expecting to sell the house, you could ensure that it it is and you can lease it for the time being. You will find your own remaining entitlement information about your own Certification off Eligibility (COE). You truly need to have your own COE in hand earlier seeking crisis numbers on your own incentive entitlement.

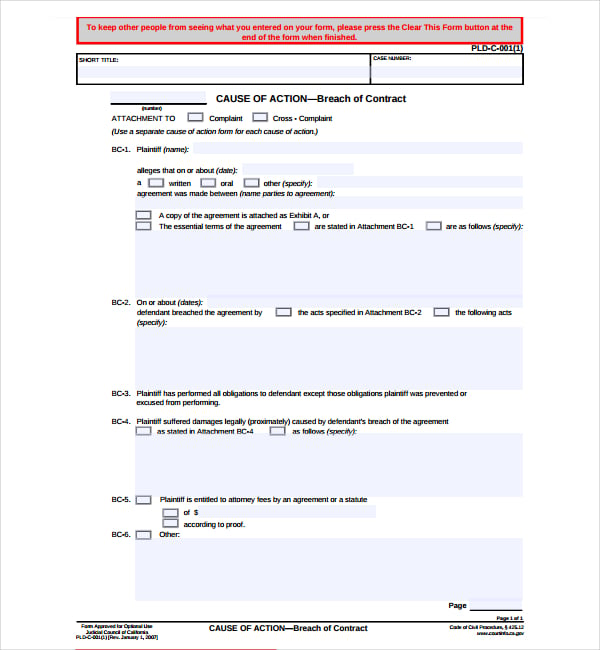

Less than are an example of exacltly what the Certificate out-of Qualifications appears instance. You have to know brand new Full Entitlement Charged so you’re able to Prior Va Fund to properly determine your added bonus entitlement and you may limitation amount borrowed to help you purchase an alternate house with your own Virtual assistant home loan work for.

If you find yourself thinking of moving a community where in actuality the condition financing maximum try $510,400, additionally the domestic you are interested in to invest in are $250,000, the main benefit entitlement computation could well be the following:

It causes having a few Va loans a good at the same big date

First, proliferate your neighborhood financing limitation by 25% to discover the restriction Virtual assistant be certain that. In this case, its $127,600.

2nd, you subtract the degree of entitlement you currently used throughout the restrict make certain to choose how much extra entitlement you have remaining.

The fresh Va will allow you to borrow up to four times the degree of your own offered entitlement having a unique financing; $77,600 x cuatro = $310,400. The brand new $310,400 shape ‘s the limit loan amount you’ll score in the place of a down payment. The new $250,000 home is underneath the restriction restrict, definition you would certainly be able to purchase the new home with no down payment.

As the $250,000 home youre looking to buy are below the $310,eight hundred, you would not be asked to build a down-payment.

Borrowers with remaining entitlement are at the mercy of the new 2021 Va loan restriction, that’s $548,250 for one-product features for the majority components of the usa. You can look up the precise compliant mortgage limit on the county for the Government Homes Loans Company (FHFA) webpages. Although many regions of the nation has a maximum Va financing limit from $548,250, specific high-costs section possess limitations that go up to $822,375.

Virtual assistant loans are not a single-big date work for; they are utilized several times as long as you see qualifications standards. You can even possess multiple https://cashadvancecompass.com/payday-loans-al/ Va loans meanwhile. This is how it could works:

> Your offer your residence and you may pay off the existing Va loan. Then you can either fix their entitlement otherwise make use of kept entitlement to pay for another type of Virtual assistant loan.

> You can keep your household and you can book it as the an investment property. You could purchase the second home utilizing your remaining entitlement.

The new Va does not give money but claims doing 25% of your own financing; which guarantee is known as an entitlement

> You’ve reduced your own previous Virtual assistant mortgage entirely but remaining new sold our home you bought on it. In this situation, you restore the entitlement, but you can simply do this onetime.

It’s important to understand how to fix their entitlement work for if the we should fool around with an excellent Va mortgage for one minute home. The brand new fix procedure isnt automatic and must become started by the experienced. To be entitled to fixing their entitlement, you truly need to have possibly sold the home you purchased that have an effective Va mortgage and you can paid back the borrowed funds, repaid your loan in full whilst still being own our home or an alternate qualified veteran takes on your loan and you may replaces its entitlement having yours. If one of them problems relates to you, you can demand fix of the entry Setting 26-1880 Request Certification out-of Eligibility to help you an area Virtual assistant control center

From the analogy over, the remaining entitlement are enough to protection the second household pick without advance payment. Yet not, for folks who planned to purchase a property that have a top value than simply $310,eight hundred without an advance payment, you would have to fix full entitlement.

Va finance is assumable – for example people buying your house can take more than a great interest plus purchasing your family. The key to consider can be your entitlement won’t be restored unless the consumer is actually an eligible seasoned who believes so you’re able to alternative their unique qualification to have yours. Although not, this new Virtual assistant will not limit who can purchase your home otherwise imagine your existing Virtual assistant financial. If you opt to sell a home to help you a non-armed forces visitors, although it dominate obligation to the mortgage payment using a prescription financing presumption, some of your Va entitlement might possibly be tied up on the property through to the mortgage is paid in complete.