Content material

On this page, I’ll give an explanation for home loan backup, make suggestions where https://paydayloanalabama.com/fairfield/ to find they during the a bona-fide house deal, and you will inform you why you need to find out about they when to purchase a house.

Very first, the loan backup permits you, the buyer, so you’re able to back out of the offer if you cannot secure money with the property because of the a specific date. The brand new backup specifies the brand new conditions significantly less than which you’ll terminate the fresh contract if you’re unable to become approved to have a home loan or if perhaps the borrowed funds terms are disappointing.

Instance, a home loan backup you are going to declare that you’ve got a particular count from weeks to try to get home financing a keen d provide proof off mortgage recognition to your vendors. Guess you cannot secure investment contained in this time period. Following, you can cancel new contract and you will discovered a full refund off your own earnest currency put.

The loan backup covers your once you can not obtain the financing had a need to purchase the home. It permits that back outside of the package in the place of punishment, instance dropping your earnest currency put because your financial situation change unexpectedly.

Where do you really get the mortgage contingency?

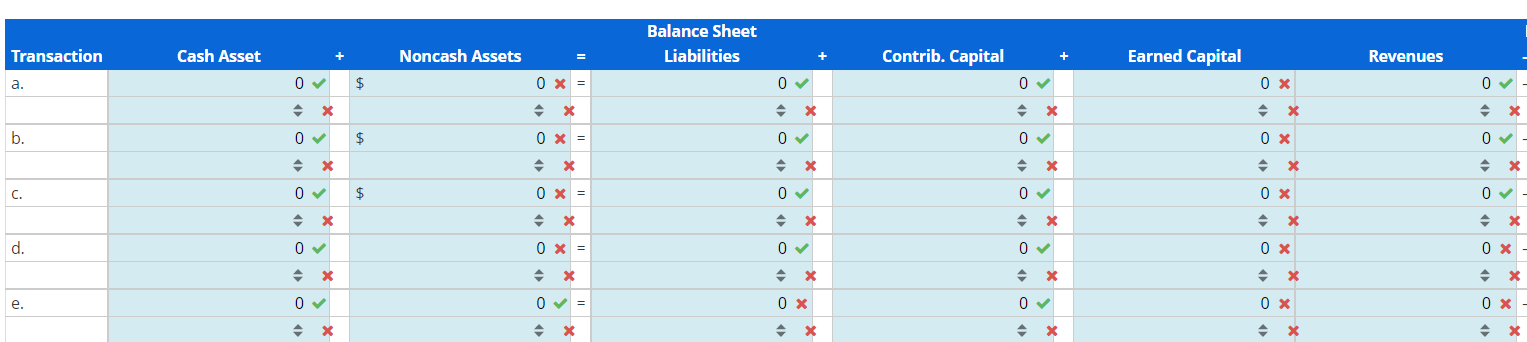

The borrowed funds backup belongs to the genuine home package. The next home loan contingency try from the Chi town Association off Real estate professionals A house Get and you may Marketing Offer. Contained in this type, the mortgage backup is actually section #5.

Financial Backup. Which price is contingent abreast of the customer protecting because of the ________________________, 20____ ( Commitment Day ) a strong written financial union for a fixed price otherwise a keen adjustable-rate home loan allowed to be produced of the a good You.S. otherwise Illinois offers and you may loan connection, financial, and other licensed financial institution, on level of $________________ of one’s Cost, the interest rate not to ever surpass _______% a year, amortized over ______ ages, payable month-to-month, financing payment not to ever meet or exceed _______%, along with appraisal and you will credit file commission, or no.

step 1. Imagine the buyer struggles to have the Requisite Commitment by this new Union Day. In that case, the customer will notify the vendor written down towards otherwise before that go out. Next, the seller may, contained in this 31 Working days pursuing the Partnership Go out (“Next Union Go out”), secure the Necessary Connection to your customer through to the same words and you will extend the newest Closing Day by the 30 Working days. The seller otherwise a 3rd party can provide the mandatory Partnership. Buyer will furnish most of the expected borrowing advice, sign conventional documents concerning the software and protecting of Expected Partnership, and shell out one to app commission as directed by the merchant. If the merchant favor to not ever secure the Expected Union having the consumer, this contract are going to be null and you will gap as of the fresh Connection Time, therefore the Earnest Currency might be returned to the buyer.

dos. Assume the customer notifies the vendor towards otherwise up until the Union Date that the buyer provides but really to get the Needed Partnership. Neither Visitors nor Provider protects the desired Commitment with the or in advance of the following Union Time. If so, so it offer would be null and void additionally the Serious Money are going to be returned to the consumer.

3. Guess the customer doesn’t give people notice towards supplier because of the Partnership Big date. In this case, the consumer are going to be considered to own waived this backup and you can it contract should stay static in full force and you will effect.

What is the mortgage connection day, and exactly why is-it very important?

The mortgage partnership date within the a bona-fide estate bargain is the big date on what the lending company is situation the mortgage relationship, discussing the mortgage words and indicating any conditions to meet ahead of closure.

This new relationship time marks the point at which you covered the new financial support needed for progressing toward pick. As the commitment big date has gone by, your future action should be to romantic the mortgage and buy the new home.

Both you and your lender would be to pay attention to the connection go out. Ensure that you might be conference any criteria required by the lender timely to quit delays regarding closing processes. The lending company is to meet up with the relationship big date. Whenever they are unable to, they must contact you, the attorneys, plus agent before the partnership big date ends.

Assume you simply can’t safe investment during the schedule given on financial backup. If that’s the case, you could potentially request an extension for longer to perform your loan. Although not, the newest providers don’t need to commit to an extension. They could maybe not if they’re worried about delays in the closure process.

How much time is a mortgage contingency?

Home financing backup is usually thirty days, as the size may differ according to the information on the fresh a house package, the fresh manufacturers, as well as the regional housing market.

The borrowed funds backup is always to allow you enough time to sign up for home financing and offer proof of financial approval into the sellers. Now body type can range from a few days to several days, depending on the regards to the new price.

Along the borrowed funds contingency can also be influence the brand new seller’s choice to just accept or reject your own render purchasing their residence. Particularly, imagine you may well ask for some time contingency. In this case, the new suppliers tends to be less likely to want to undertake your own give, as they is generally concerned about your own money choice. Additionally, whether your backup is just too brief, you want more time to apply for a home loan and you will found a response throughout the bank.

If you waive the loan backup?

Waiving the mortgage contingency tends to be just demanded when you are convinced it is possible to hold the property’s money. Think about, the borrowed funds backup allows you to straight back out from the transformation deal if you can’t get financing from the a specific big date. For people who waive the fresh new backup and cannot get financing, you could clean out your serious currency to your supplier.

Ahead of waiving the loan backup, consider carefully your power to safe resource. It would be wise to talked about the matter along with your a house lawyer, agent, and you can lending company to understand the dangers inside.